A look back at the first Réussites Solidaires: working...

Taxe d'apprentissage 2024: Donating to KEDGE means contributing to a desirable future!

As a graduate of the school, you have the power to help talented young people in their professional and personal projects, by participating in the success of our new apprenticeship tax collection campaign.

My apprenticeship tax: instructions for use ✨

🚀 The 2024 apprenticeship tax campaign has begun and the SOLTéA platform is now accessible to employers (companies).

As a graduate, you have the opportunity to target KEDGE to allocate your tax balance.

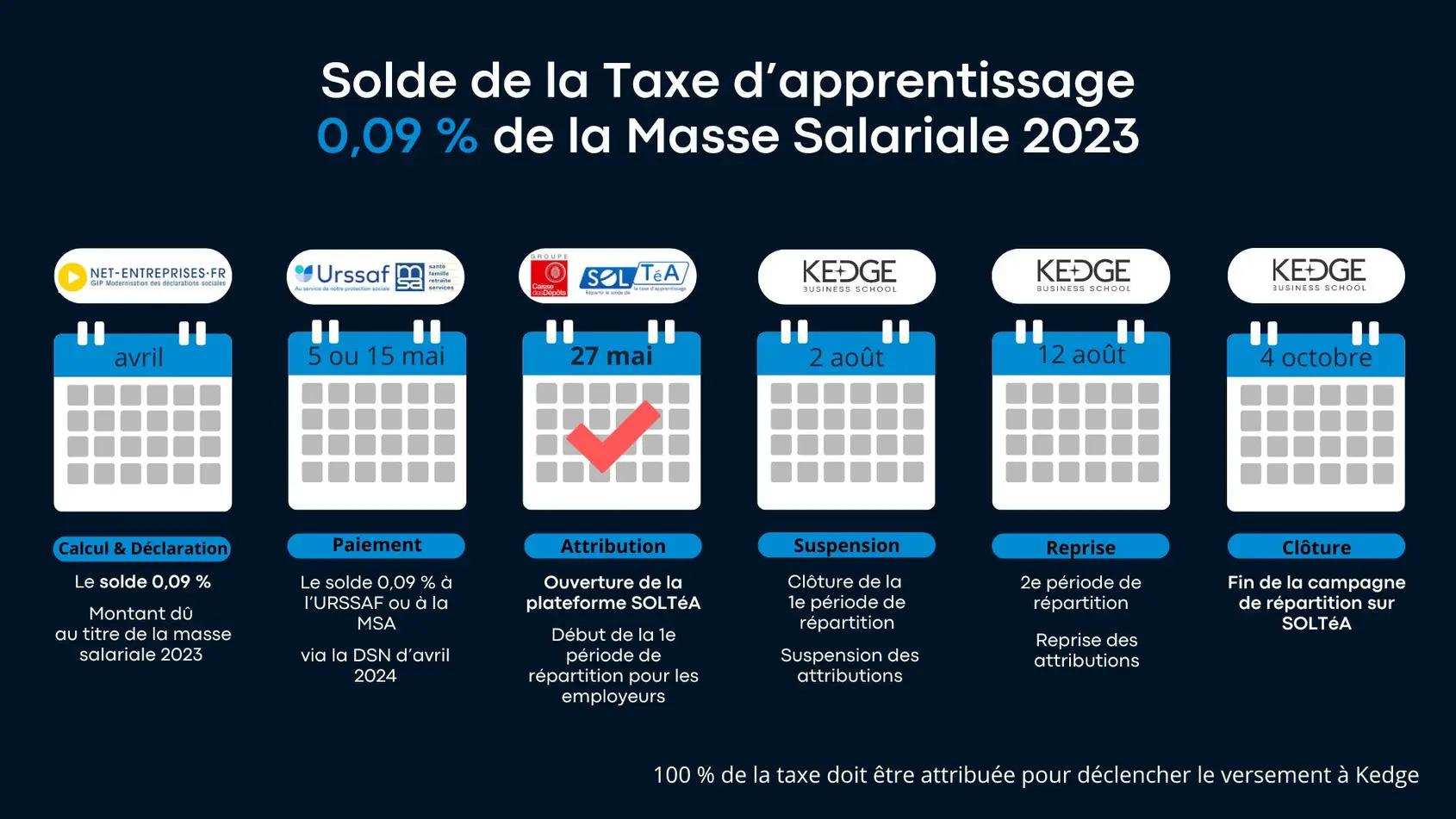

Below you will find the timetable and detailed information for the payment of your balance 👇

🤝Our tips for using the SOLTéAplatform

SOLTéA: How to find KEDGE Business School on the platform and allocate your balance in 3 steps

- 👉Step 1: Log in to your SOLTéA account.

- 👉Step 2: Once logged in, click on one of the links below: you'll be taken to the assignment page for our campuses. It is important to be already logged in with your SOLTéA account before clicking on the direct links.

- 👉Step 3: Enter assignment %: On the summary page, you can enter a % for each school or course, by clicking on the pencil picto. Please note that if the total of the values entered does not equal 100%, you will not be able to validate. Finally: click on the "Save my allocations" button to finalize.

You can also find KEDGE on SOLTéA using the UAI codes:

Bordeaux campus: UAI 0333326L

Marseille campus : UAI 0130239P

Toulon campus: UAI 0831448Y

Paris Campus: UAI 0755839P

👀 Documents to download

🚀 KEDGE supports you

KEDGE voted Best Corporate Relations 2023 by AGIRES Synergie

For the third year running, KEDGE has been voted "Best Corporate Relations" in the Management School category by the Agires Synergie Awards.

0 Comment

You must be logged in to leave a comment.

No comment